Federal W4 2025. This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. As soon as new 2025 relevant tax year data has been.

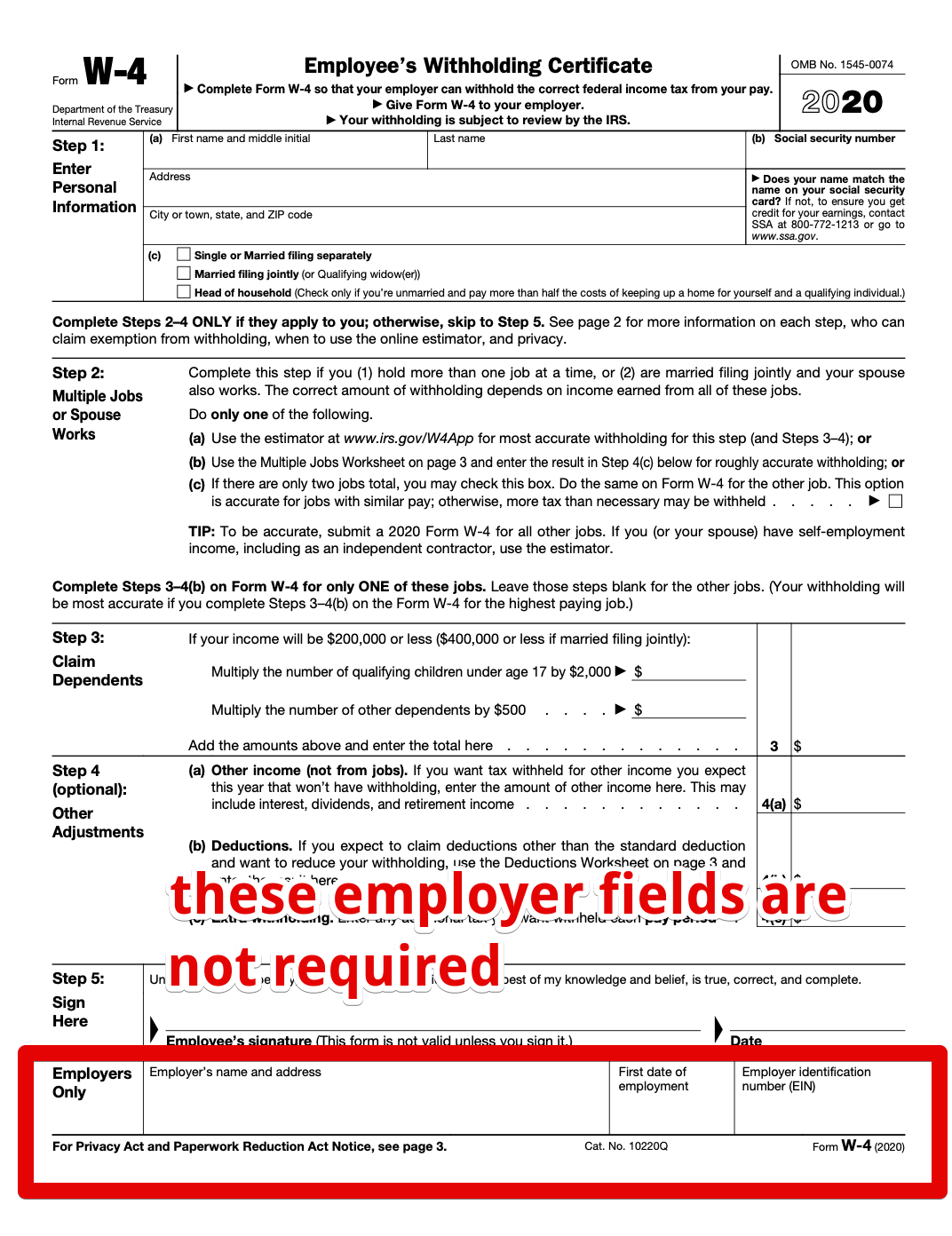

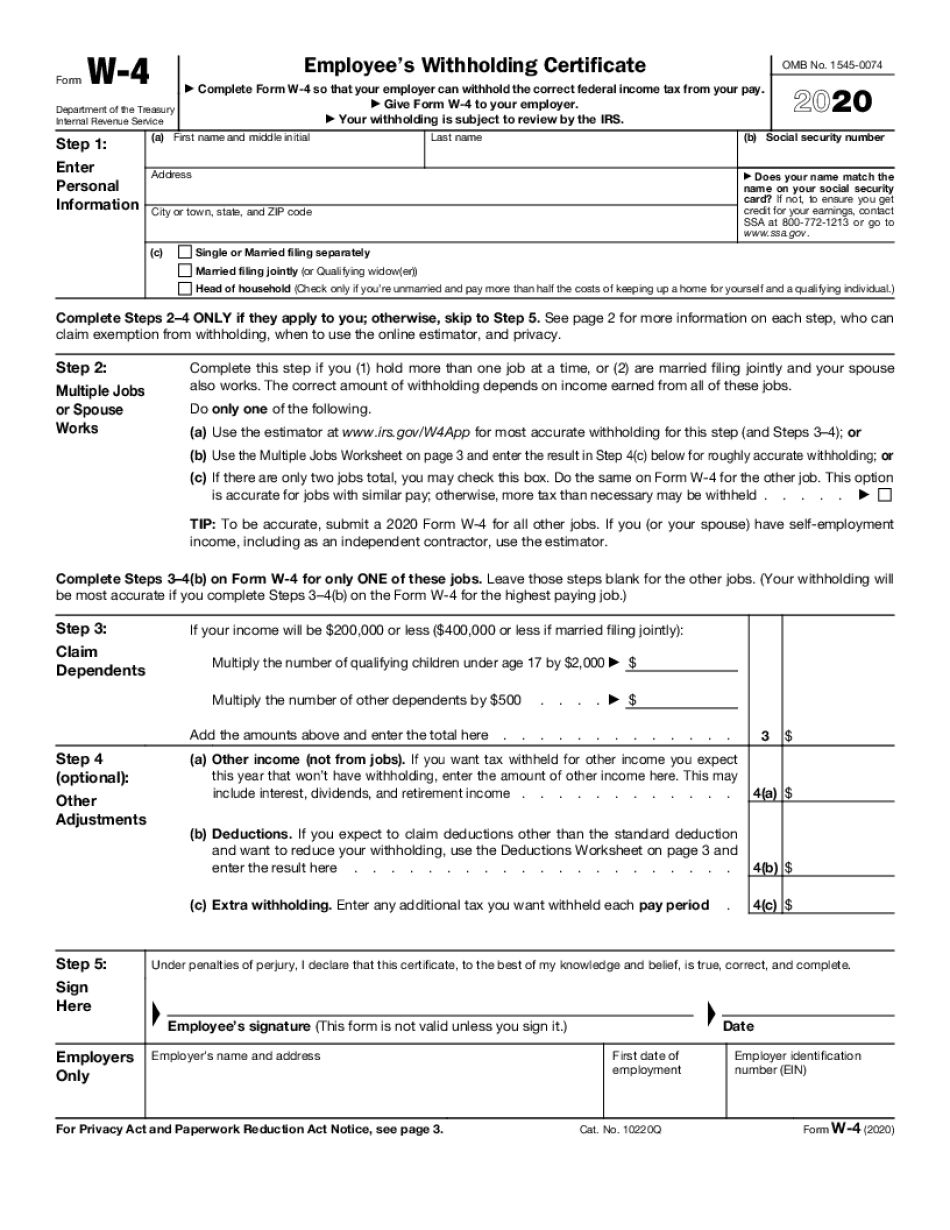

It tells the employer how much to withhold from an employee’s paycheck for taxes. This form requires you to provide information such as your expected filing status, family income from other jobs, number of dependents, and tax deductions you.

This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

W4 employer fields CareerPlug, On this page, we will post the latest tax information relating 2025 as it is provided by the irs. Sign the form and give it to your employer.

Here's How to Complete The New IRS W4 Form Because Nearly Everyone is, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

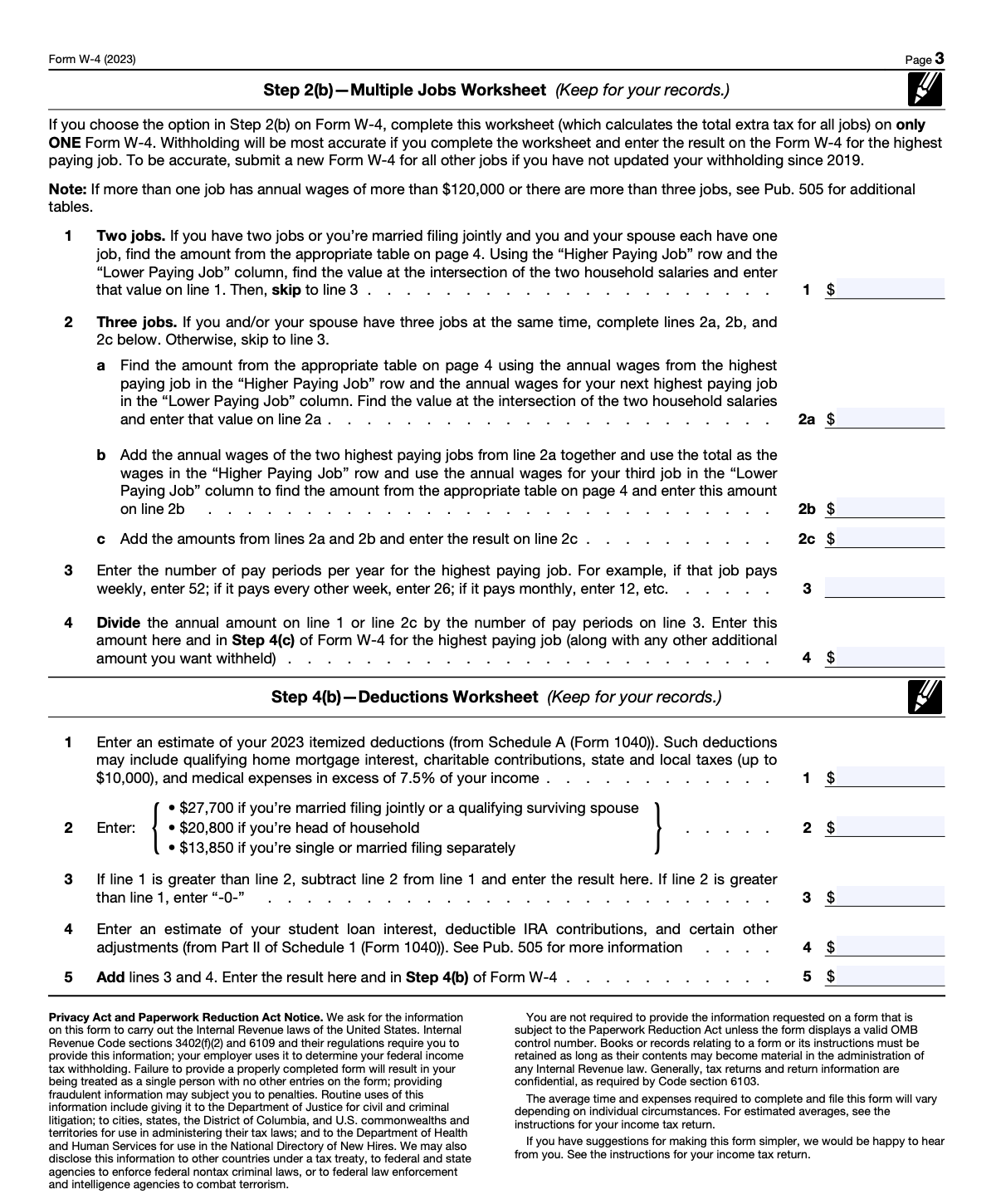

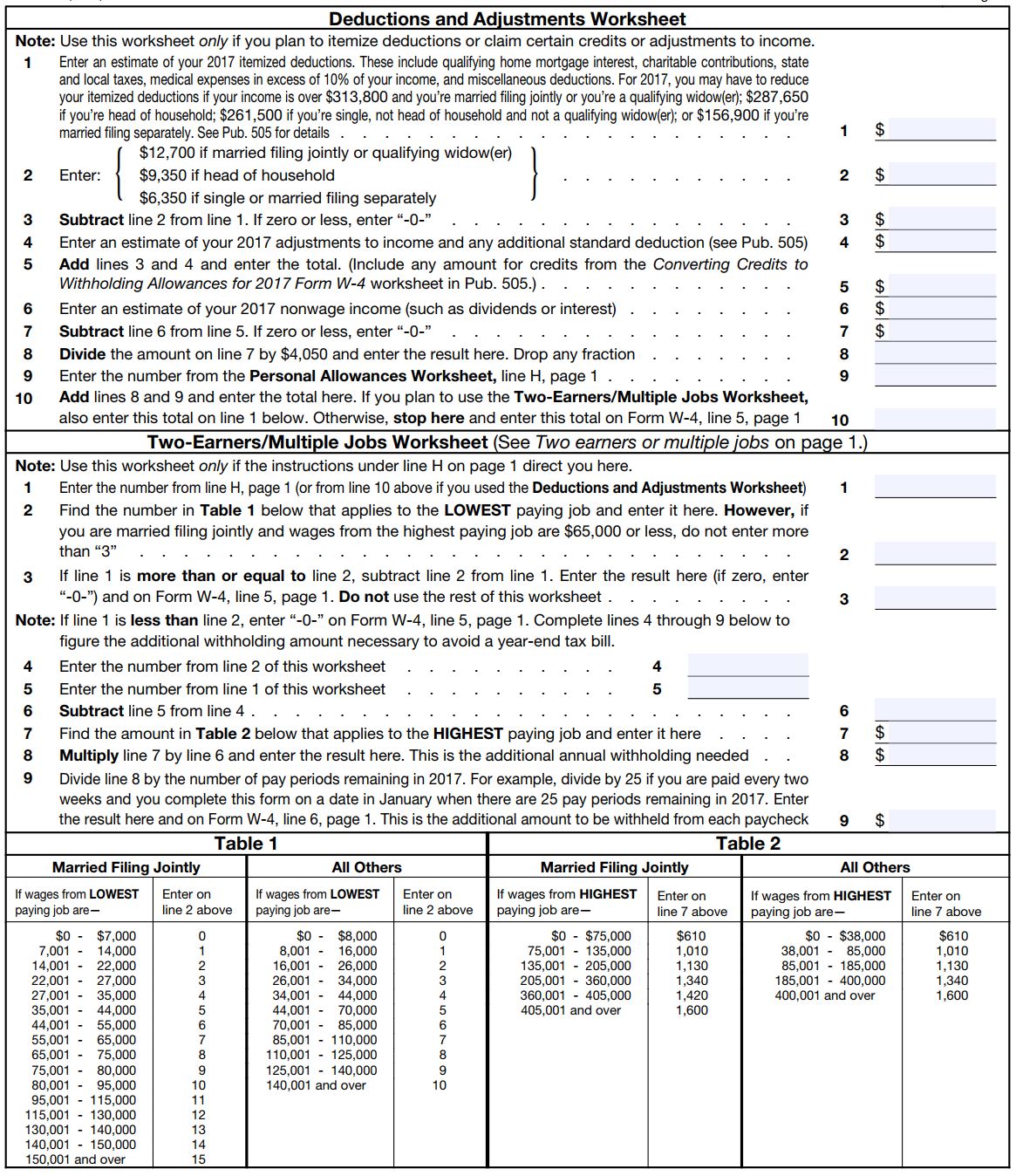

Worksheets A Allowances, With this form, also known as an employee’s withholding certificate, you can adjust how much federal income tax gets withheld from each paycheck to align with. Heritage’s project 2025 proposes reviving the trump schedule f policy that would try to reclassify tens of thousands of federal workers as political appointees, which.

W4 Form Employee's Withholding Certificate Instructions, 54 OFF, See current federal tax brackets and rates based on your income and filing status. It tells the employer how much to withhold from an employee’s paycheck for taxes.

How to Fill Out Your W4 Form in 2025 Tax forms, W 4 form, Tax, Find tax return calculators for. For employed individuals, withholding refers to the federal income tax amount deducted from their paycheck.

How to Complete the W4 Tax Form The Way, Irs tax forms is a webpage that provides various forms and instructions for filing your federal income tax. Project the amount of federal income tax that you will have withheld in 2025, compare your projected withholding with your projected tax, and determine whether the amount.

W4 Withholding Calculator 2025 Joby Rosana, It tells the employer how much to withhold from an employee’s paycheck for taxes. If you meet certain criteria, such as having no tax liability in the.

Understanding the Federal W4 Form Innovative Business Solutions, Project the amount of federal income tax that you will have withheld in 2025, compare your projected withholding with your projected tax, and determine whether the amount. Heritage’s project 2025 proposes reviving the trump schedule f policy that would try to reclassify tens of thousands of federal workers as political appointees, which.

W4 2025 Calculator Merl Stormy, You owed no federal income tax in the prior tax year, and. As soon as new 2025 relevant tax year data has been.

Tax Forms & Deductions. ppt download, Project the amount of federal income tax that you will have withheld in 2025, compare your projected withholding with your projected tax, and determine whether the amount. You owed no federal income tax in the prior tax year, and.